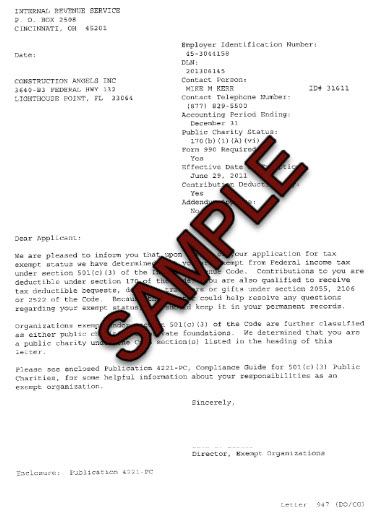

A 501(c)(3) organization is a type of non-profit organization that is recognized by the United States Internal Revenue Service (IRS) as exempt from federal income taxes. To be classified as a 501(c)(3) organization, a non-profit must be organized and operated exclusively for charitable, religious, educational, scientific, literary, or other specific purposes.

There are many different types of non-profit organizations that may qualify for 501(c)(3) status, including:

Charities: Organizations that provide direct assistance to those in need, such as food banks, homeless shelters, and disaster relief agencies.

Educational institutions: Organizations that provide educational opportunities to students, such as colleges, universities, and private schools.

Religious organizations: Churches, synagogues, mosques, and other religious institutions may qualify for 501(c)(3) status if they meet certain requirements.

Scientific and research organizations: Non-profits that conduct research in a specific field, such as medical research or environmental science.

Literary and artistic organizations: Museums, libraries, theaters, and other cultural institutions may qualify for 501(c)(3) status if they promote the arts and provide public access to cultural resources.

To be recognized as a 501(c)(3) organization, Kappa Foundation of Seattle has met certain requirements, including having a clearly defined charitable purpose, operating on a non-profit basis, and having a governing board that operates in the public interest. Additionally, donations made to 501(c)(3) organizations are tax-deductible for the donor, which can help to incentivize donations and support for the non-profit’s mission.